In his speech before the Independent Community of Bankers of America on March 17, 2004, the Chairman of the Federal Reserve Board, Alan Greenspan, concluded that the US banking system is in healthy shape. According to the Fed Chairman, the weakness in credit quality that accompanied the recent recession has clearly been mild for the banking system as a whole, and the system remains strong and well positioned to meet customer needs for credit and other financial services.

The latest data, however, indicate that there is some deterioration in the quality of bank credit. In the fourth quarter, the charge-off rate of real estate loans rose to 0.26% from 0.13%, while the consumer loans charge-off rate jumped to 3.04% in the fourth quarter from 2.76% in the previous quarter.

Furthermore, not once during his entire speech did Greenspan mention the Fed’s policy that has driven down interest rates to their current lows, much less how this policy is a major factor behind the appearance of a supposedly strong banking system.

The Fed’s policy can generate the illusion of success, to be sure. But when it is reversed—as it inevitably must be—the illusion is shattered to reveal the painful facts of reality. Contrary to Greenspan, the expansion of the banking system and its apparent strength is built on shaky foundations.

Good credit versus false credit

There are two kinds of credit: that which would be offered in a market economy with sound money and banking (good credit) and that which is made possible only through a system of central banking, artificially low interest rates, fractional reserves, deposit insurance, and bailout guarantees (false credit).

Banks cannot expand good credit as such. All that they can do in reality is to facilitate the transfer of a given pool of savings from savers (lenders) to borrowers. To understand why, we must first understand how good credit comes to be and the function it serves.

Consider the case of a baker who bakes ten loaves of bread. Out of his stock of real wealth (ten loaves of bread), the baker consumes two loaves and saves eight. He lends his eight remaining loaves to the shoemaker in return for a pair of shoes in one-week’s time. Note that credit here is the transfer of “real stuff,” i.e., eight saved loaves of bread from the baker to the shoemaker in exchange for a future pair of shoes.

Also, observe that the amount of real savings determines the amount of available credit. If the baker would have saved only four loaves of bread, the amount of credit would have been only four loaves instead of eight.

Furthermore, note that the saved loaves of bread provide support to the shoemaker, i.e., they sustain him while he is busy making shoes. This in turn means that credit, by sustaining the shoemaker, gives rise to the production of shoes and therefore to the formation of more real wealth. This is a path to real economic growth.

The introduction of money does not alter the essence of what credit is. Instead of lending his eight loaves of bread to the shoemaker, the baker can now exchange his saved eight loaves of bread for money (i.e., sell his stock for money) and then lend the money to the shoemaker. The shoemaker in turn can exchange the money for goods and services he requires.

Observe that money fulfils the role of a claim against real goods and services. This simply means that the holder of money expects to be able to exchange them for goods and services whenever he requires. Thus, when the baker exchanges his eight loaves for eight dollars he retains his real savings, so to speak, by means of the eight dollars. The money in his possession will enable him, when he deems it necessary, to reclaim his eight loaves of bread or to secure any other goods and services.

The existence of banks does not alter the essence of credit. Instead of the baker lending his money directly to the shoemaker, the baker will now lend his money to the bank, which in turn will lend it to the shoemaker. By lending his money, the baker temporarily transfers his claims over real resources to the bank. The bank in turn lends these claims to the borrower, who is the shoemaker.

In the process the baker earns interest for his loan, while the bank earns a commission for facilitating the transfer of money between the baker and the shoemaker. The benefit that the shoemaker receives is that he can now secure real resources in order to be able to engage in his making of shoes.

Despite the apparent complexity that the banking system introduces, the act of extending credit remains the transfer of saved real stuff from lender to borrower. Without the increase in the pool of real savings, banks cannot create more real credit. At the heart of the expansion of good credit by the banking system is an expansion of real savings.

Now, when the baker lends his saved eight dollars we must remember that he has exchanged for these dollars eight loaves of bread. In other words, he has exchanged something for eight dollars. So when a bank lends those eight dollars to the shoemaker, the bank lends fully ‘backed-up’ dollars, i.e. fully backed-up claims on real resources.

Trouble emerges however, if instead of lending fully backed-up claims a bank engages in issuing empty claims (fractional reserve banking) that are backed-up by nothing. Rather than fulfilling the role of intermediary, i.e., facilitating the transfer of savings from lenders to borrowers, the bank now gives rise to a diversion of real savings from wealth generating activities to activities that are lower on the consumer’s list of priorities.

When unbacked claims are created, they masquerade as genuine money that is supposedly supported by a real stuff. In reality however, nothing has been saved. So when such claims are issued, they cannot help the shoemaker since the pieces of empty paper claims cannot support him in producing shoes. What he needs instead is bread.

Since the printed money masquerades as proper money it can however be used to “steal” bread from some other activities and thereby weaken those activities. This is what the diversion of real wealth by means of money out of “thin air” is all about. If the extra eight loaves of bread weren’t produced and saved, it is not possible to have more shoes without hurting some other activities, which are much higher on the consumer’s lists of priorities as far as life and well being are concerned. This in turn also means that unbacked credit cannot be an agent of economic growth.

Rather than facilitating the transfer of savings across the economy to wealth generating activities, when banks issue unbacked claims they are in fact setting in motion the weakening of the process of wealth formation. It has to be realized that banks cannot pursue ongoing unbacked lending without the existence of the central bank, which by means of monetary pumping makes sure that the expansion of unbacked claims doesn’t cause banks to bankrupt each other.

We can thus conclude that as long as the increase in lending is fully backed up by real savings it must be regarded as good news since it promotes the formation of real wealth. Only false credit, which is generated out of “thin air”, is bad news. Low interest rate policies by the Fed both encourage the expansion of false credit and discourage saving, in a process that brings about continually weakening financial conditions.

Curiously some commentators are of the view that any type of credit helps grow the economy. This way of thinking is based on a crude empiricism, which supposedly shows that the expansion in bank lending and the expansion in economic growth are closely correlated. However, only credit which is backed up by real savings is an agent of economic growth. Credit which is unbacked by real savings is an agent of economic stagnation.

Furthermore, regardless of how sophisticated and advanced the banking system is, if it is engaged in the expansion of unbacked claims it will promote misery and not economic prosperity. Hence, while it is important to have a sophisticated banking system for facilitating the transfer of real savings it is real savings and not banks that give rise to economic growth.

The banking sector is very vulnerable

To be sure, the existence of fractional reserve banking and all the other institutions that assist in the creation of false credit have been in place for a very long time, generating ongoing bouts of boom and busts and distorting the economic system. What makes the prospect more serious this time is the low savings rate, the rock-bottom interest rates, the sad condition of household balance sheets, and the vulnerability of banks themselves.

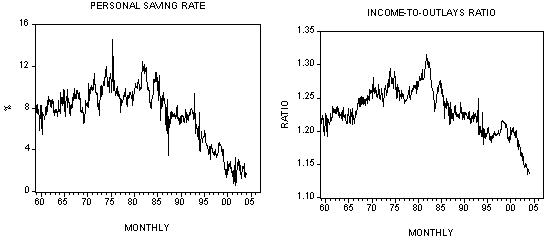

The rapidly diminishing ability of the US to generate internal real funding is seen in collapsing consumer savings and ever expanding government. For instance, the consumer savings rate stood in January at 1.8% against 10.4% in April 1980. The personal income-to-personal outlays ratio is currently in free fall. The pace of individuals’ spending is much faster than the pace of income generation.

Furthermore, the level of consumer credit in relation to disposable income is at a record high. Also, home mortgages as a percentage of disposable income rose to a new record high of 82% in the fourth quarter from 77.4% in the first quarter. Furthermore, in the first quarter of 1981 the nonfinancial debt-to-GDP ratio stood at 1.33 against a record high of 2.9 in the fourth quarter of 2003.

In sum, the pace of credit expansion by far outstrips the pace of income generation. This is another indication that the pool of real savings is in trouble. If it would have been otherwise then income would have grown much faster and would have easily absorbed any increase in debt.

Furthermore, we shouldn’t overlook the magnitude of monetary increases since 1980. The following chart depicts the magnitude of a destructive monetary explosion – the product of loose monetary policy of the Fed and fractional reserve banking. In February money AMS stood above its trend by $1,260 billion against $960 billion in January 2001. Also, note the massive monetary explosion since the early 1980’s.

Another important drain on real resource remains the ever-growing size of the government. Contrary to most analysts, it is not the budget deficit as such but rather government spending that weakens the pool of real savings. It is growing government spending that does the damage by diverting real resources from wealth producers.

Between December 2000 and December 2003 government expenditure increased by 33%. Moreover government spending stood above its long-term trend by $122 billion in December 2003. In December 2000 spending was $37 billion below the trend. Furthermore, the Federal debt stood above $7 trillion in December last year.

Consequently, on account of prolonged monetary pumping and an ever growing government, what we likely have at present is a stagnant or declining pool of savings which is accompanied by accelerating levels of debt. This in turn leads us to conclude that it is highly likely that savings do not support a large portion of credit, i.e., the high level of unbacked debt makes the banking sector very vulnerable.

While banks are the greatest beneficiaries of the false boom, they cannot escape the negatives of the bust. So long as the pool of savings is still growing and a loose monetary policy is maintained, banks can continue to show good performance.

Once the Fed tightens its stance for whatever reason—perhaps to shore up the dollar or rein in prices—or banks decide to curb their unbacked credit expansion, economic activities that sprang up on the back of false credit are likely to be exposed as unsustainable. Since these false activities are part of bank balance sheets this means that the quality of the banking sectors’ assets must be deteriorating.

Against the background of deteriorating savings conditions and rising debt, how is the US economy managing to show a reasonable performance? The answer to this can be found in the balance of payments. For 2003, the US current account deficit closed at $541.8 billion—up from $480.9 billion in 2002. In early 2004 the trade gap has continued to widen further. It stood at $43.7 billion in January against $42.7 billion in the previous month.

The continued widening in the trade gap is the manifestation of a positive net stream of real resources coming from the rest of the world to the US. The fact that the US can print dollars that are eagerly accepted by foreigners enables it to divert resources from the rest of the world. To put it briefly, by means of printing presses the US keeps its economy going at the expense of the rest of the world.

For the time being, not only are foreigners happily channelling their real resources into the US but they are also doing this in return for the liabilities of a non-wealth generating entity called the US government. Foreigners are exchanging real stuff for unbacked promises. For instance, at present, foreign central bank holdings of T-Bonds exceed $1.1 trillion, or 10% of US GDP. So at the moment, the US remains at the mercy, so to speak, of the rest of the World.

We can thus conclude that the banking system is far from being in healthy shape as suggested by Greenspan, but on the contrary it is very vulnerable to a sudden weakening in economic activity.

Also, contrary to Greenspan’s view, the banking system is not well positioned to expand credit since there is very little savings left. Any further bank credit expansion means an expansion of credit out of thin air. Obviously, this type of credit expansion will only further undermine the health of the economy and ultimately the bank’s own health.

In fact, since a large chunk of credit was created out of “thin air” there is high likelihood that it will evaporate back into “thin air.” It seems to us that against the background of rapidly deteriorating real fundamentals the Fed will be forced in the not too distant future to reverse its stance, thus setting in motion the inevitable liquidation of various artificial forms of life that currently comprise bank balance sheets.