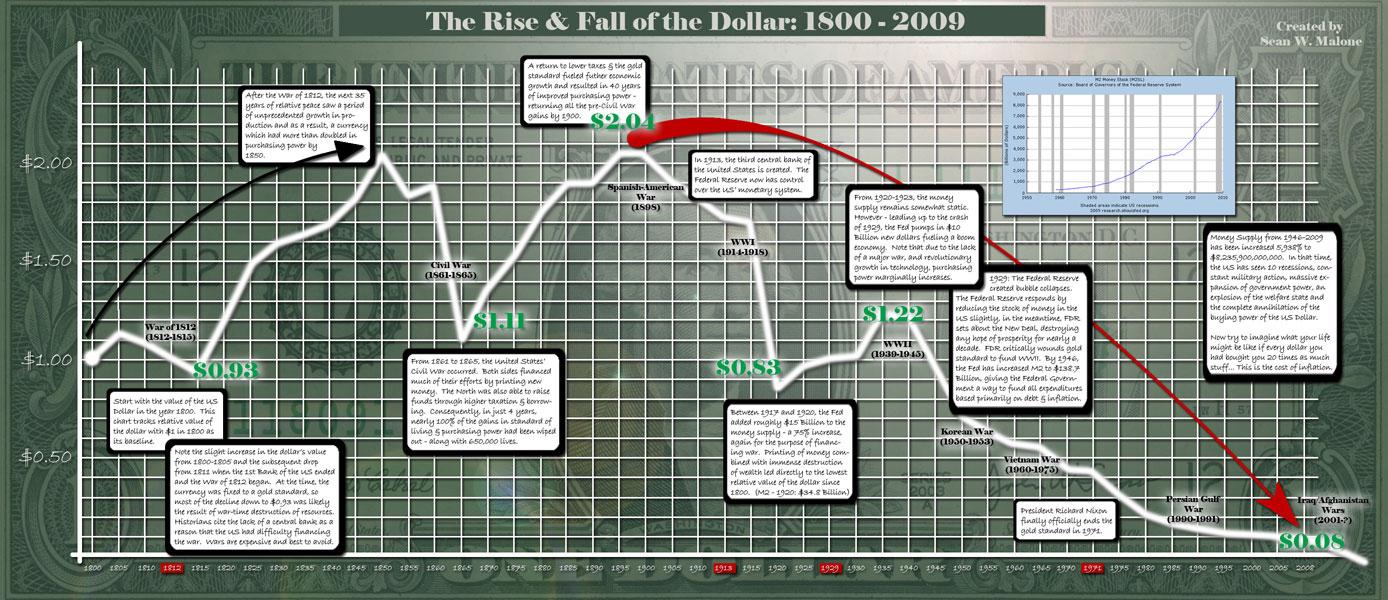

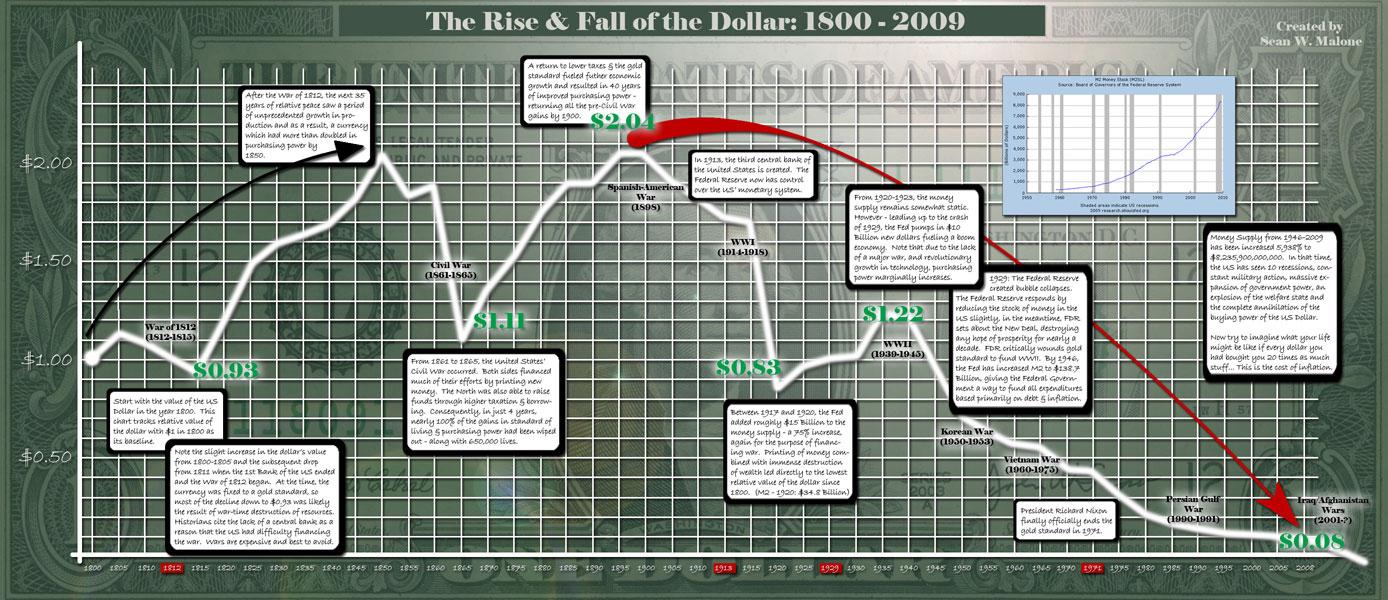

Mises Daily contributor Sean Malone has created this wonderful graphic summary of the rise and fall of the US dollar from 1800 until now:

Mises Daily contributor Sean Malone has created this wonderful graphic summary of the rise and fall of the US dollar from 1800 until now: